By , Contributor,

Taherian is a lecturer in the Graduate School of Management, аТАФУХСљКЯВЪФкФЛаХЯЂ Davis. This story is reprinted in part from an that appeared in Forbes.

McKinsey has been conducting a (as part of its across 42 countries) starting in mid-March. This is an interview with , a Senior Partner at McKinsey, and head of McKinseyтs Global Retail and Consumer Packaged Goods practices, on revelations from the firmтs latest a .

1. Can you share with us the key findings of the survey conducted June 1-7, 2020?

U.S. consumer confidence in the recovery of the U.S. economy has declined since mid-March and remained steady since late April, but remains higher than in European countries. Overall, more than 60 percent of Americans are extremely or very concerned about the U.S. economy, outpacing concerns such as overall public health and not being able to make ends meet.

This generation-shaping event has had the fastest and most dramatic effect on consumer behavior of anything we have observed in our lifetimes. Some headwinds are much more significant: more than 40 percent of Americans reporting a reduction in household spending and consumers are starting to shop in a very different way т which is a big shock to loyalty with more consumers either switching where they shop or the brand they buy.

Across our research, five key themes are emerging that will most likely stick in terms of consumerism:

- Flight to online. As stores have closed, more consumers have moved online, which is a trend that is likely to continue post-COVID. The number of consumers who now use digital channels to access goods and services across categories, and expect to do so in the future, has increased by an average of about 20-25 percent. I believe it not would be an overstatement when we say that many retailers have accelerated a multi-year online penetration in a handful of months.

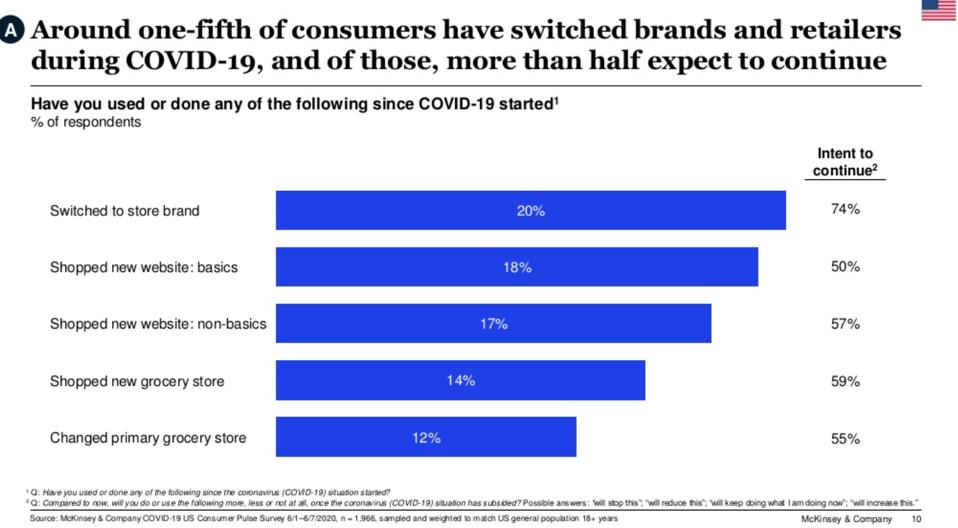

- Shock to loyalty. As consumers struggle with limited access and availability, brand loyalties are being challenged, with 40-50 percent of consumers having shifted stores, websites, or brands during the crisis and 20 percent switching primary stores or brands. Further, more than half say they plan to stick with the new store or brand.

- Need for hygiene transparency. Hyper aware of safety concerns, consumers seek to limit contact, creating a frictionless experience. For example, more than 75 percent of self-checkout users and more than 60 percent of "buy online pick-up in store" users plan to continue to use that service post-crisis.

- Return to essentials and value. Basket composition has shifted towards essentials and value over impulse buying. More than 60 percent of consumers expect to reduce spending on non-essential categories.

- Rise of home as the center of life. Staying at home has driven a rise in the domestic arts т such as cooking and at home entertainment. More than 40 percent of consumers expect to spend more time cooking over next two weeks, even as we are months into social distancing measures.

2. While spending is below pre-COVID levels, the survey showed positive indications for discretionary purchases. How are retailers preparing for the recovery?

Suzy Taherian

Suzy Taherian

Intent to purchase has started to rebound in some food and discretionary categories т including grocery, household supplies, and entertainment at home. There is also positive momentum and green shoots showing in categories such as food takeout and delivery, alcohol, personal care, skincare and makeup, gasoline and pet care.

Retailers certainly have a full plate right now in planning for the recovery, this includes first and foremost, reopening stores. Of course, part of the reopening includes managing customer and employee hygiene and safety, and retailers also have the added complexity of revisiting their staffing models and changing their playbook to drive traffic and demand generation.

Another important aspect is managing margin dilutions, such as promotional intensity and markdowns, as the pressure of unsold inventory builds up. Retailers will need to look to aggressively clear their inventory, but not swing the pendulum to be overly promotional as they emerge from shelter in place. On the other end of the spectrum, retailers will have to be thoughtful on influencing buys for the future, as they balance demand uncertainties with the need to plan and buy for the next season.

Finally, there is a need to double down on the push to e-commerce, as well as on direct-to-consumer and loyalty. We have seen a decade of digital penetration amidst COVID, however this may even out post-COVID as the penetration levels right now are inflated, given stores are closed. But we do believe there is stickiness to this .com behavior and retailers are pushing to capture the .com demand now while getting the digital channel ready for post-COVID. Brand and retailer shifts (store and online) are taking place about 15-20 percent of the time across retail categories, and those customers that switch are more than 50 percent likely to say they will continue with their new choice. Leading retailers are reinvesting in their direct-to-consumer relationships and loyalty programs to make sure this is an opportunity, rather than a risk to their business.

3. The survey noted that three-fourths of consumers who have switched brand indicated they intend to continue with the new brand. What can retailers do to build brand trust?

Convenience has been redefined as customers are drastically changing the way they make choices. Throughout the crisis, many Americans have switched away from go-to brands and/or retailers. Our research shows that consumers are making the switch due to convenience, availability, and value, but factors like trust and safety are gaining importance.

Consumers are also concerned about how companies are treating their employees, as safety precautions for their own employees is a bell weather for consumers thinking through which companies are making reasonable decisions about safety.

Put into numbers, 20 percent have switched to a store brand, while roughly 15 percent have tried a new grocer. And across both, about half of consumers expect to maintain their choice after COVID-19. With 20 percent of customers up for grabs, this is an opportunity for retailers to recapture customers that may have switched in recent months т and re-secure their loyalty.

As a moment of truth, retailers need to reset the gameboard and win with consumers using granular insights т at the market level and at the customer level т to inform decision making, both immediate and longer-term such as investing in e-commerce to cater to emerging customer segments- targeting, media planning, messaging, and store re-openings.

4. Consumers moved online for shopping and food ordering. What do retailers need to do to capitalize on this trend?

As we think about the move to online and the omnichannel behaviors, there are at least four actions that I think retailers need to take:

- Drive traffic to online and omnichannel offerings т Be present with the right mix of products and services, and incisive marketing where the consumer is. As consumers focus their attention on digital media while at home, advertisers are reporting that video and search/social/eCommerce are providing the highest return on investment.

- Ensure you have the right assortment online т This is evolving now and will continue to change in the future. For example, casualization of retail, value-oriented price points are becoming increasingly important.

- Be realistic on fulfillment т Many retailers are lagging normal fulfillment times but consumers seem to accept this if itтs communicated clearly to set the right level of expectations

- Deliver exceptional customer service and delight т There can be a lot of frustration with lagging and inadequate customer service right now. Retailers need to focus on getting this right to keep online shoppers coming back

While it is not completely clear yet, we believe there may be a willingness to go back to stand-alone stores versus malls, and I think this is an interesting one to watch.

5. There is more optimism in Gen-Z and higher-income Americans for economic recovery. Their positive outlook is translating into higher intent for online shopping for discretionary items. Are retailers taking specific actions to appeal to these two segments?

Yes. For example on Gen-Z, retailers are going where the younger consumers are to reach them online, and there has also been an increase in the offering of buy now pay later offerings (known to be targeted at Gen-Z / Millennial audiences.

For the more affluent consumers that are online, retailers are doubling down on personalization to attract more of the share of wallet, as the behavior shifts online.

Survey showed 34 percent of U.S. consumers were optimistic on economic recovery.

6. Economic restart varies by geography. Are retailers looking at more local decentralizing branding, marketing, channel optimization to respond to these geographic variations?

Across the funnel, geo-focused marketing is even more critical right now, as recovery is proving uneven at the country level. Retailers need to think about pairing geo opening/ restriction status with early demand signals.

Further, consumers in different geographies will return to in-store shopping at different points in time and often consumers are making their own decisions on when to return to тregularт out-of-home life based on multiple signals including the visible safety precautions retailers are taking (e.g., extra sanitization and cleaning).

7. How are non-economic trends (such as sustainability or social justice) impacting consumer behavior?

We are seeing varying perspectives on sustainability depending on what geography we look at.

On social justice, most brands and retailers took a pause to marketing - rightfully so т acknowledging not just Blackout Tuesday but pausing media beyond that and are just now looking to understand how to restart and also bring content and messaging that is resonant. Given retail as a sector accounts for such large number of employment, I personally find it very encouraging to how many retailers have gone on record to share their commitments around their diversity and inclusion initiatives.

The global pandemic is the ultimate litmus test of whether brands have a clear and compelling purpose т thatтs backed by action. This is a seminal moment to solidify what really matters for your brand, and for your messaging to have real substance. The actions that management teams take now in large part will define their strength not only through the crisis, but into the recovery and the future.